Twinkas is one more Ponzi scheme similar to the famous MMM scheme, which has already begun trending with memberships in various categories. According to this scheme, it is said that www.twinkas.com, was created ‘in order to promote the greatest good, but with a certain emphasis on helping people and the environment’.

It is said that it had already revised all the technical and also logical issues about the front-end and has provided some mobile numbers to help facilitate the exchange process of money. But after MMM scams in South Africa, the trust to such organizations is rapidly falling down.

Is Twinkas still paying?

READ ALSO: Another ponzi scheme NairaCash reportedly crashes

They say they keep restoring their CRM Modules (Mobile Calls, Ticket, and Live Chat) to enable them to get in touch with clients regularly. They have already switched to strict mode. It means no tolerance. Hence, they will entertain no form of uncanny behavior from the sponsors or down lines. Twinkas has also rolled out a few conditions, even including the warning that all prospective investors should keep their smartphones switched on most of the time and be online if they want to succeed.

Read also

Avoid frozen chicken, turkey: NAFDAC sends warning to Nigerians

The representatives of Twinkas add that if a sponsor’s smartphone is switched off or, for example, not answering calls for more than 5 Hours, Twinkas will block such account. In case if a sponsor does not activate his referral after receiving the payment, the same situation will happen - Twinkas will block this account and all other subsequent accounts connected to this bank account and mobile number. They advise downloading some online banking Application on sponsors’ mobile phones to help facilitate the general process. All needed mobile numbers will be always displayed on some specific dashboard.

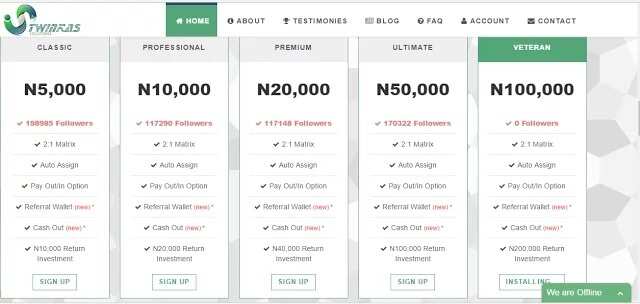

A sponsor should save them and beware not receive any calls from other lines telling to have emanated from Twinkas. It must warn their investors against pestering of the numbers for different trivial Issues. People may call these numbers only in the cases of some emergency, for example, hacked accounts or some other serious Twinkas related problems. People can also use the ‘Live Support’ and their Ticketing System for different serious Twinkas issues. According to the official website, ‘Twinkas’ Classic now has 198,985 Professionals with 117,290; the Ultimate with 170,322 participants; Twinkas Premium has 117,147 participant; has zero participant under the Veteran category’.

Read also

Media tips: How Twitter helps journalists improve news sourcing & monitoring in digital media age

Any sum invested in each of these categories should attract double amount after only one-month maturity. Under Classic, members invest N5, 000 and get V10, 000 in return; the members of the Professional platform invest N10, 000 and get N20,000 return. Members of Under the Premium level put N20, 000 investment and then get N40, 000; Ultimate members have a contribution of N50, 000 and get N100, 000 return. The Veteran scheme means you invest N100, 000 and get N200, 000 in return, however, none has invested on the platform.

Different concerned citizens and also financial institutions had already warned against membership in such Ponzi schemes because they are nothing but a fraud. ‘How to invest in mmm’ was one of the most popular requests in Nigeria that time. However, previously a lot of Nigerians had been warned against MMM Africa a couple months before it was distress and had yet to fully pick up. Nigerians were also warned by the CBN not to invest money in any institution that has not been insured by the NDIC (Nigeria Deposit Insurance Corporation).

Read also

The future belongs to creators, says Rotimi Bankole as he launches SBI Media Workshop

The Director of Corporate Communications, whose name is Mr. Isaac Okoroafor, has also warned Nigerians about MMM schemes. Okoroafor said that now when the economy had already suffered some decline, all Nigerians had to be extremely careful with companies and people they deal with.

Also, any institution that has not been licensed by the CBN to get deposits must not be given money to keep under any pretext. He added that they could vouch for the whole banking system. And the deposit money banks have always been the only licensed Nigerian institutions to accept deposits.

If you want to deposit money, then go to one of the licensed deposit money banks and give your money there, you can buy, for example, fixed income instruments or you can invest in different stocks. The experts say that people often come with different interesting propositions. But there are a lot of fraudsters who are ready to collect money of Nigerian people and disappear as soon as they reach the goal. There isn’t any insurance as the NDIC cannot protect Nigerians against different risks when they happen.

Read also

Infinix to launch most powerful gaming and entertainment smartphone ever

Latest news on MMM scheme

Famous Ponzi scheme which is called ‘MMM’, has spread like real wildfire and a lot of people have signed on to this dangerous scheme, which the promoters call ‘a mutual fund’. MMM offered the participants 30 per cent growth rate per month for every donation they make into the system.

MMM belongs to the scheme, which sustainability depends on members’ activities, which make up the general Nigerian MMM community. That means all MMM Nigeria participants. Usually, MMM promoters offer rates far beyond the numbers that are obtainable in any commercial bank. Of course, it attracts a lot of people who rush to become rich. But, unfortunately, people only lose money and get nothing.

In December 2016, the MMM subsidiary in Nigeria suspended work for 30 days. Mavrodi explained the temporary closure of the department by disagreements with the government and the media, which, he said, were spreading rumors about the Internet pyramid, which had hindered its development. As a result, about three million depositors lost their funds totaling $ 16 million.

Read also

CBN’s FX restrictions killing our businesses, Nigerians cry out

Nigerian authorities and banks also tried to protect people from fraud, but it was impossible to influence inspired investors. After the closure of the Nigerian branch of ‘MMM’, a branch of the Internet pyramid appeared in Ghana and Kenya.

In January 2017, the Commission on Economic and Financial Crimes and the Securities and Exchange Commission of Nigeria said that organizations like ‘MMM’ represent a direct ‘threat’ to citizens.

But this again did not diminish the popularity of MMM, and in the same month, the branch of the financial pyramid opened again in Nigeria, announcing the opportunity to invest money through bitcoins. The depositors promised that their lost funds would be compensated in the form of bonuses. And on YouTube, there are more and more videos with Nigerians, who are happy with the return of ‘MMM’ in their country.

If you have ever wanted to become any Ponzi scheme or MMM member – forget about it. They are frauds, which will make you even poorer than before.

Read also

Exclusive: Legit.ng's Managing Director shares 5 digital trends to boost your business in 2020

The information was taken from Vanguard.

READ ALSO: Helping hands Nigeria: Scam or real?

Source: Legit.ng

ncG1vNJzZmivp6x7rbHGoqtnppdkfnGFk3JtcWWkrLavt8CsZJqmn6m1pr6MqaanspliwKS0xKacZqaZnLKztcBmqZ6onJawpnnMpqRnoKSiuQ%3D%3D